CBRE calls this a golden time for developers to participate in ready-built factories and warehouses in major cities and key industrial zones.

Recently, the giants providing logistics services in the world simultaneously revealed their business plans in Vietnam. They expect the world’s leading fast-growing economy, the shift of manufacturers – supply chains after the impact of the US-China trade war, a market with e-commerce is booming. explosive like a storm, at the same time is also in the few countries that have well controlled the COVID-19 pandemic …

GLP (Singapore), Asia’s largest warehouse company, has just announced that it wants to establish a $ 1.5 billion joint venture in Vietnam, combined with SEA Logistic Partners. This group plans to develop a total of 335,000 m2 of land around Hanoi and HCMC.

A few days ago, LOGOS Property (Australia) acquired 13 hectares of land in VSIP Bac Ninh Industrial Park to deploy logistics facilities and warehouses with the scale of 80,000 m2. This deal was made immediately after the establishment of the US $ 350 million LOGOS Vietnam Logistics Venture joint venture over a month.

A CBRE report released in May said that during a pandemic outbreak, demand for ready-built warehouses increased dramatically. Meanwhile, the number of inquiries for other industrial properties declined due to travel restrictions and social isolation. This stems from the presence of imports and exports due to the interruption of transportation and the strong growth of the e-commerce segment.

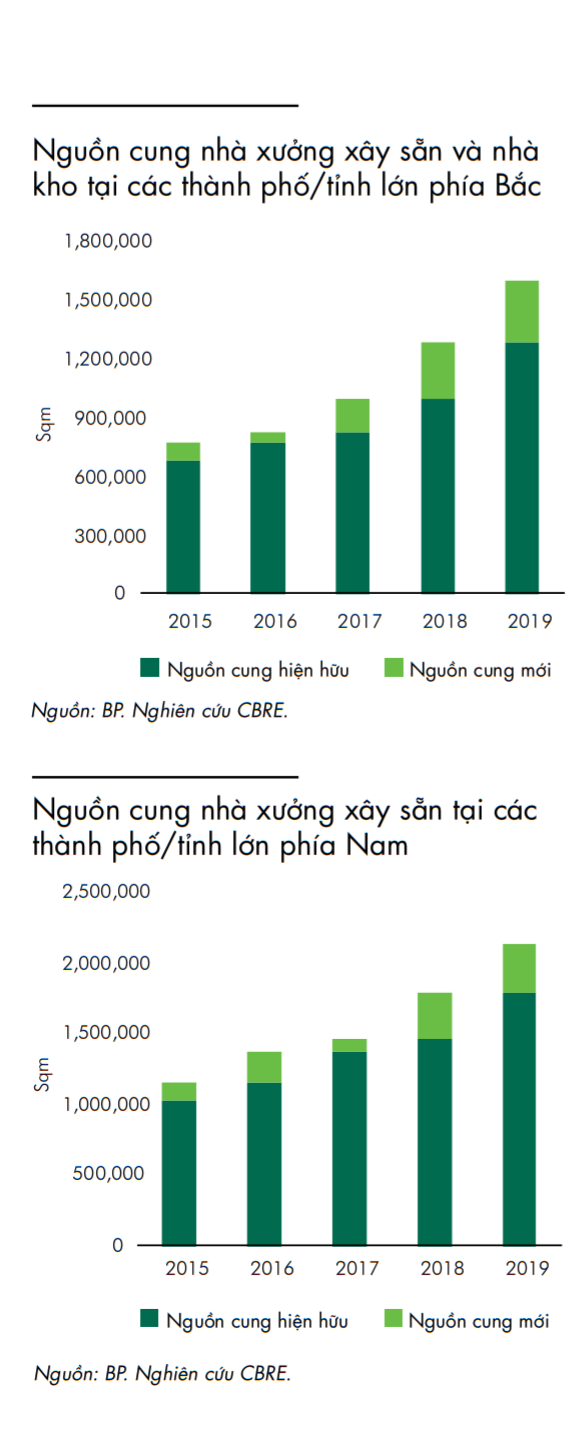

The ready-built factory and warehouse market recorded good performance, with rents remaining stable. CBRE’s recognition shows that factory and ready-built warehouse supplies continue to grow in two main industrial areas, the South and the North.

According to Pham Ngoc Thien Thanh, Deputy Director, Research and Consulting Division, CBRE Vietnam: “It is expected that by the end of 2020, the total supply of ready-built factories and warehouses in the Northern regions will reach nearly 2. million m2 of floors for lease (up 25.3% year-on-year) In the South, the total area of ready-built factories will reach nearly 2.7 million m2 (up 28.2% compared to the previous year). With the pandemic under control, the average asking rents for ready-built warehouses are expected to increase from 4% to 11% over the same period.

CBRE experts stated that, with positive business results despite COVID-19, the ready-built warehouse market is expected to grow stronger thanks to new changes in trend with both sources. supply and demand.

“The need to expand storage space and distribution network of e-commerce companies is and will dominate the demand for warehouse rental. Along with that is the need to find land funds for logistics facilities to increase.

Temperature controlled storage spaces (cold or cool storage) will be seen as new developments in the logistics industry as the fresh food distribution and sales network expands significantly in both methods online and at existing stores and supermarkets.

In areas where there is a limited supply of industrial land, a high-rise warehouse model has also begun to emerge to create larger storage space for the needs of e-commerce companies.

According to the Vietnam Logistics report 2019, about 70% of the warehouse area is currently concentrated in the South. In which, Saigon Newport Company with a total area of 675,000 m2 of warehouse, including CFS warehouse, bonded warehouse, department store, and distribution center is the largest warehouse service provider in the country. Next is Sotrans with a total warehouse area of more than 230,000 m2.

Besides, many other big names in the industry include Mapletree, Gemadept, Vinafco, DHL, YCH-Protrade, Damco, Transimex, IndoTrans, Draco …

CBRE studies also show that the warehouse market will concentrate in strategic provinces. In the North, it will be around Hanoi, Hai Phong, and Bac Ninh that play an important role in the development of industrial parks and logistics; The south will focus on HCMC and neighboring provinces.

Because the warehouse rental market is so attractive and potential, more and more international giants are attracted by this “piece of cake”.

One of the names supposedly has a strong background in both finance and professional experience – BW Industrial (BW Industrial Development Joint Stock Company), a joint venture between Warburg Pincus and Becamex IDC.

BW Industrial has an initial investment of more than $ 200 million, with 380 hectares of land bank (in 2019), will expand by 200 hectares by 2020 to meet the growing market demand.

Mr. Jeffrey Perlman, CEO and Chief Representative of Southeast Asia at Warburg Pincus said: “BW plans to build and develop a platform for industrial real estate and logistics services to meet demand. increasing from many multinational corporations, 3PLs and leading e-commerce companies in the world … “.

Since its establishment in early 2018, BW Industrial has expanded its scope of activities from South to North. In 2019, the company brought in revenue of 66 billion dong, but due to its new operation, the net loss was 89 billion dong. On the other hand, gross profit margin of more than 66% shows the attractiveness of this business segment and its future profit prospect as revenue scale increases.

Or as the number one real estate developer in Vietnam – Vinhomes Joint Stock Company (a member of Vingroup) cannot stand out from this trend. VHM IZ was established with the responsibility of investing thousands of billion VND to develop industrial zones in the Northern provinces such as Hai Phong, Quang Ninh … Thereby, the field of warehouses, ready-built factories is a difficult segment to leave. by.

Although Vingroup itself has withdrawn from VinCommerce, it is nurturing another ambition in the retail segment with VinShop (developed by One Mount Group). This is an application that connects the supply of goods directly from the manufacturer to the grocery store owners, B2B2C model appeared for the first time in Vietnam. Characteristics of this model will need a large area of warehouse for handling goods.

Mr. Nguyen Tran Thi – Logistics Operations and Product Development Director of One Mount Group said that the company will focus on developing technology solutions, building a data platform that can be managed and controlled. services on a large scale, building standardized processes to ensure that the end-to-end supply chain can be optimized.

One Mount Group itself will cooperate with strategic logistics partners, both domestic and foreign, to take advantage of the available infrastructure and operating experience of the partners. One Mount Group currently has 20,000 square meters of warehouse to handle nearly 100,000 products per day.

Returning to rental logistics developers, a recent emerging trend to adapt to the higher demands of customers is “industrial factory 4.0 generation”, using technology to and more convenient for tenants.

Generation plants 4.0 apply virtual reality technology to bring their workshop space to customers anytime, anywhere. The service package includes free legal, human resources and accounting to help customers apply for a license even while overseas.

With the generation of factories 4.0, KTG Industrial is emerging as one of the pioneers in implementing the new situation.

According to our research, a series of companies belonging to KTG Industrial ecosystem have been established since the beginning of the year, including KTG companies Nhon Trach – Nhon Trach 1, KTG Bac Ninh, KTG Hung Yen, KTG Dong Nai , KTG Industrial Long Thanh, KTG Industrial Yen Phong… These are all capital locations for industrial zones of Vietnam.